Intellectual Property Rights: Don’t Forget?

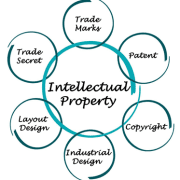

Intellectual capital is often the key objective in mergers and acquisitions. Despite the importance of intellectual property rights (IPRs), intangible assets and goodwill, the assets are routinely misunderstood and are often under-valued, under-managed or under-exploited.

“The cardinal rule of commercial valuations is that the value of something cannot be stated in the abstract; all that can be stated is the value of a thing in a particular place, at a particular time, in particular circumstances.” Before a valuation of IPRs, intangible assets and goodwill can be carried out, the questions “to whom?” and “for what purpose?” must be asked. The context is all-important for the seller to receive potentially a higher value for their business.

Sell-side valuations must include the values of the talents, skill and knowledge of the workforce, training systems and methods, technical processes, customer lists, distribution networks, trademarks, patents, copyrights, etc. Specific drivers of owner (enhanced) value will vary from buyer to buyer.

Lack of adequate preparation before beginning the selling process is always a major pitfall. Optimizing value and closing requires that IPRs, intangible assets and goodwill are included in all discussions of shareholder value.

Leave a Reply

Want to join the discussion?Feel free to contribute!